March 29, 2004, 06:51

William J. Hansen, Ph.D.Hamilton Ventura: First Electric Watch

Many of us have, at one time or another, heard about the Hamilton Ventura. This remarkably interesting watch was the "Watch of the Future", designed by Richard Arbib, and released to the public with great fanfair in 1957. Elvis wore one, as did Rod Serling. Years later, the Men In Black Movie used the quartz version in this series of films, creating another level of interest.

This watch was sold in a 14K yellow gold version, and a more rare 14K white gold version. It was also reportedly offered for sale as an "export" version (where "solid gold" watches were required to be 18K, rather than 14K) in 18K yellow gold, and 18K Rose gold.

A high quality example of the 14K yellow gold Ventura, restored and under warranty by Rene Rondeau "The Dean of the Hamilton Electrics" and author of the Book, "Hamilton Wristwatches, A Collector's Guide" & "Watch of the Future", will set you back about $2000.

Rene is selling an 18K version from his own collection. I thought you might enjoy seeing this magnificent and profoundly rare watch.

http://cgi.ebay.com/ws/eBayISAPI.dll?ViewItem&item=4102076034&category=31387Bill Hansen

IHC# 198

March 29, 2004, 12:09

Phil DellingerBill,

Thanks for bringing this watch to our attention. A very interesting timepiece.

What do you think the winning bidder will have to pay for this one?

Too bad he didn't include a picture of the movement in his auction.

Phil Dellinger

March 29, 2004, 12:13

William J. Hansen, Ph.D.The price will be interesting.

An Altair model recently sold for 4K.

A Solid Gold Pacer Recently sold for 8K.

Given the extreme Rarity, and the fact that it was owned by and restored by Rene Rondeau...

10 to 12K wouldn't be shocking.

At least not unless I shell out that amount, and my wife finds out!

Bill Hansen

IHC# 198

March 29, 2004, 16:19

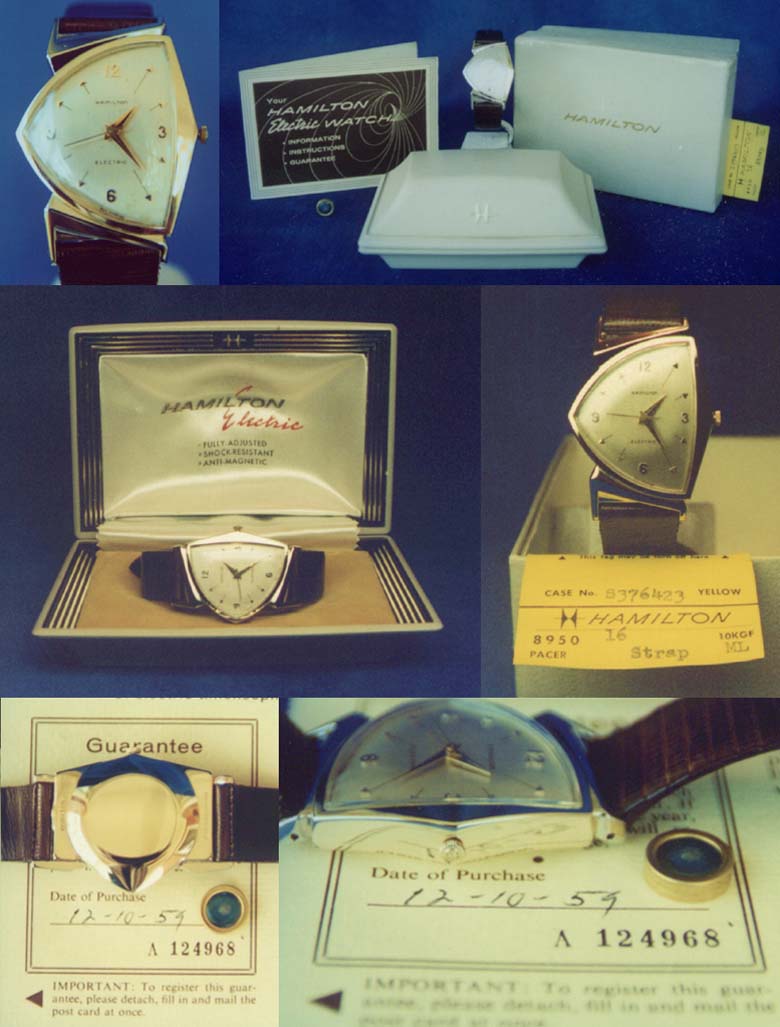

Steve MaddoxA few years ago, I sold a Pacer with all the correct matching papers and boxes for $1k. An image of it appears below.........

That's one watch I wish I had back, but I'd be shocked if the 18k Ventura brings five figures. I know it's rare (at least in this country), but it doesn't

look any different than a regular Ventura. If I was going to plop down a big wad of cash like that on a Hamilton Electric, I'd buy something like an "Altair."

==================

Steve Maddox

Past President, NAWCC Chapter #62

North Little Rock, Arkansas

IHC Charter Member 49

March 29, 2004, 16:49

Jeffrey P. HessAwesome Steve..

anmy ide who you sold it to? Would the guy sell it back to you??

aWESOME!!

Jeff Hess

March 30, 2004, 06:29

Steve MaddoxJeff,

I sold the Pacer above to a lady in Ireland in either 1997 or 1998. I could probably find the records of the transaction, but I've never really considered it. At the time, that was all the watch was really worth, and to be perfectly honest, I don't think it's worth any more than that now when the appropriate currency conversions are calculated.

We Americans have an illusion that the price of stocks, gold, silver, gasoline, watches, etc., are all going up. What most of us fail to understand, however, is that the prices we see are all based solely upon the increasingly volatile value of our US currency. In reality, it isn't so much that the prices of commodities have gone up, it's that the value of the US dollar has gone down in a BIG way. Compare the price of gold, gasoline, or any other major commodity to any other major international monetary standard, and the reality of the situation will become painfully apparent.

In early 2002, $100 would buy about 71 British pounds, but by early 2004, the same $100 would buy only about 54 British pounds, for a decline of about 24%. Similarly, $100 in early 2002 would have bought $167 Swiss francs, but by early 2004, it was worth only 122 Swiss franks, for a decline of about 27%. As compared to Euros, $100 in early 2002 was worth about 113 Euros, but by early 2004, the value had fallen to only about 78 Euros, for a decline of about 31%.

In short, people who had $100k US in the bank 2 years ago, may still have that same amount on paper, but today it's only worth about 75% of what it was. In other words, although most people fail to realize it, every person who has some form of savings linked to the US dollar, has now lost about 25% of their total purchasing power in just the last two years alone. Similarly, a person who earned $100k per year in 2002 and is fortunate enough to still be employed at that same wage today, is now working for about $75k per year comparatively.

That may be shocking, but it's true, and the situation shows no signs of changing. At a world financial conference 10 weeks ago in Berlin, Alan Greenspan was quoted as saying:

"To date, the widening to record levels of the US ratio of current account deficit to GDP (gross domestic product) has been, with the exception of the dollar's exchange rate, seemingly uneventful." At the time, it was noted that the US dollar had suffered a 25% decline against major international currencies since early 2002, and had declined 16.7% against the Euro in 2003 alone.

The reason for the US dollar's decline in value is not difficult to see. The US ran a current account deficit of $135 billion during the third quarter of 2003 alone. That gap (the broadest measure of international trade because it includes investments) equaled 4.9% of the nation's gross domestic product, and was exceeded only by the record 5.1 and 5.2% deficits during the first and second quarters of 2003. Reports for the last quarter are not yet available (as far as I know).

A "current account deficit" means that a country is consuming foreign goods and services at a rate beyond its ability to pay. Countries finance such purchases by borrowing the savings of other countries through bond issues and similar securities that are held by foreign banks and investors. The most recent data shows that Japan increased its holdings of US Treasury securities by $17.5 billion in October, 2003, to a total of $501.9 billion. China boosted its holding during that same period by $4.3 billion, to a total of $141.9 billion. Together, they hold 44.1% of the $1.46 trillion (that's $1,460,000,000,000.00) in US Treasury securities held abroad. Foreign governments account for $859.2 billion of that total, while private foreign investors hold the remaining $600.8 billion.

According to Roger Kubarych, a former Federal Reserve Board staff economist who now works for Hypovereins Bank in New York,

"The main reason there haven't been bigger consequences from the huge US current account deficit is that it's been financed by the central banks of Asian governments. If these Asian central banks hadn't intervened, the US dollar's decline would have been huge." Of course, if losing 25% of one's income and total life savings in 2 years isn't "huge," I'd hate to think what would have happened if we hadn't mortgaged our futures to the Chinese and other Asian investors. Needless to say, it's going to be interesting to see what happens when that note comes due. I suppose that makes it a bit easier to understand why the US continues to grant "Most Favored Nation" trading status to a country who utilizes child and prison labor to directly compete with goods produced by American workers in the US market.

If only I'd invested the $1k I got for that Pacer in gold, or silver, or anything else that would have held its value, rather than keeping it in US dollars, I'd have a much better chance of being able to buy it back again today! $1k invested in either gold or silver in 1998, would today be worth about $1,500, but if I had that watch again today, I'd probably sell it again for that amount!

=====================

SM

March 30, 2004, 06:47

Jeffrey P. HessSteve,

R I G H T ! ! ! !

Every tie gold or platinum takes a jump I get email asking me why?

I tell them, well, gold did not go up, the dollar moved...

No one seems to understand that.

Right now, for instance, Guys in the UK who collect American watches should be filling the holes in their collections while they can.

The pound is lilke 1.84 or something! Sheesh.

When the pound was 1.04 in 1987 or so, I made WEEKLY trips to London and brought back huge sutcases full of Waltham coin and sterling silver keywinds... my cost? About 40 bucks per.

IT was nuts.

When the currency pendulum swings back this way (or that way depending on you country of origin) the Brits will be selling back to us their duplicates in their collections and making out like bandits...

Jeff Hess

March 30, 2004, 07:32

William J. Hansen, Ph.D.Steve, I agree with your assessment and reasoning regarding the 18K Ventura.

Nevertheless, it is resting at 9100, and I continue to believe that in the last 8 seconds, it will shoot upward and land in the neighborhood of $12500.

Bill Hansen

IHC# 198

March 30, 2004, 14:32

Andy KrietzerNot in the same league as the real one, but I had a Hamilton replica in the early 1990s. It was made and sold by Hamilton, but it was probably imported. This was one of several that was stolen out of my house in 1997, and I have always wondered if it had any resell value, or being a replica, is it just a novelty? Do they have any value now? I think I paid somewhere around $250 or more new. I still have the box. It had a serial number on the back, but I have no record of that now. Insurance only paid about half of what my reciept showed. I think it had a calendar movement, as I could hear the date change when I would set it, but no date was visible on the dail. It was gold plated. I have always wondered about this one that got away.

Andy

So many clocks, so little time. The International 400 Day Clock Chapter 168.

The Internet Horology Chapter 185

nawcc-ihc.orgApril 05, 2004, 22:18

William J. Hansen, Ph.D.Evidently it is to late to edit my previous post about this watch. Provenance, being crucial to my previous love (wine) is equally important with wristwatches. Given the stature of the seller, the rarity of the watch, and the "relative" value of the final price, the addition of this investment grade Hamilton was too much to resist.